Why Penn State Health Paid a Penalty?

Penn State Health (PSH) recently paid over $11.7 million to resolve voluntarily self-disclosed violations related to Medicare claims for Annual Wellness Visit (AWV) services. The settlement serves as a stark reminder: even well-intentioned healthcare organizations can face devastating financial consequences when AWV documentation and coding fall short of Medicare’s exacting standards.

The Root Cause: A Documentation Misstep

PSH discovered the issue through an internal review, which revealed that the clinical record documentation did not appropriately support a significant cohort of billed AWV services. This wasn’t a case of intentional fraud, it was a systemic failure to meet Medicare’s specific documentation requirements for a service that looks deceptively simple on the surface but carries substantial compliance risk.

Why Are AWVs a High-Risk Service?

The Medicare Annual Wellness Visit offers healthcare systems an opportunity to enhance patient health through preventive care while capturing legitimate revenue. However, the AWV’s strict documentation requirements make it one of the most audit-vulnerable services in the Medicare program.

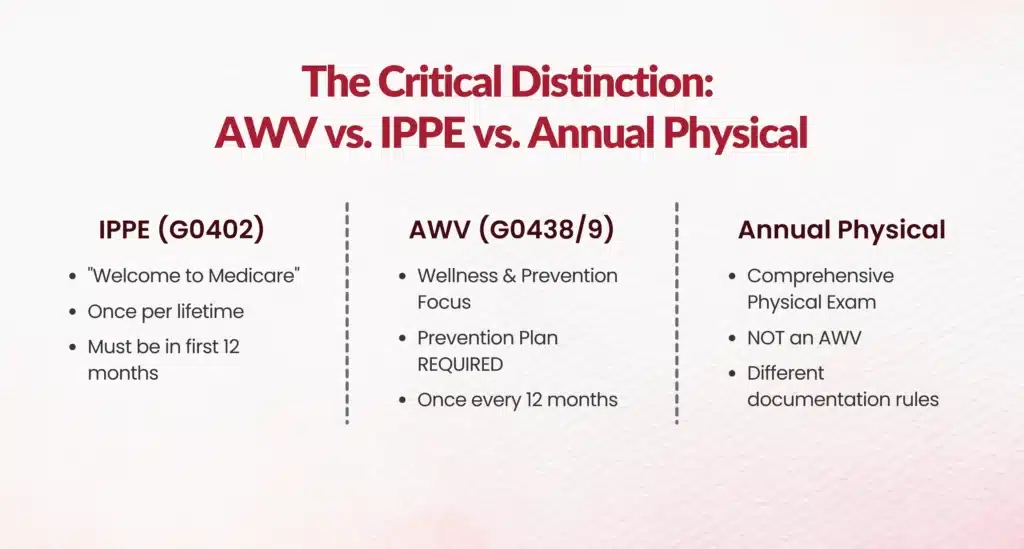

The Critical Distinction: AWV vs. IPPE vs. Annual Physical

Many practices perform AWV-level work without proper coding or documentation or worse, code an AWV when documentation doesn’t support it. Understanding the differences is essential:

Initial Preventive Physical Examination (IPPE) - CPT G0402

- The "Welcome to Medicare" visit

- Available once in a lifetime

- Must be completed within the first 12 months of Medicare Part B enrollment

- Different documentation requirements than AWV

Annual Wellness Visit (AWV) - CPT G0438/G0439

- Initial AWV (G0438): Covered after the first 12 months of Medicare Part B coverage

- Subsequent AWV (G0439): Covered once every 12 months after the initial AWV

- Cannot be billed in the same year as IPPE

- Requires specific documentation elements that differ from a traditional annual physical

Traditional Annual Physical Examination

- The AWV and IPPE are not comprehensive physical examinations

- They are wellness-focused visits that address health risks, necessary screenings, and preventive planning

- Focus on the patient's emotional, psychological, and physical well-being

The Documentation Requirements That Cost $11.7 Million

Medicare’s AWV requirements are precise and unforgiving. Missing even one required element can render the entire claim unsupportable. The required documentation includes:

For Initial AWV (G0438):

- Health Risk Assessment

- Establishment of medical and family history

- List of current providers and suppliers

- Measurement of height, weight, body mass index (BMI), and blood pressure

- Detection of cognitive impairment

- Review of patient's functional ability and level of safety

- Establishment of a written screening schedule (next 5-10 years)

- List of risk factors and conditions for which interventions are recommended

- Personalized prevention plan - This is where many organizations fail

For Subsequent AWV (G0439):

- All of the above, plus

- Update of medical and family history

- Update of list of current providers

- Review and update of personalized prevention plan

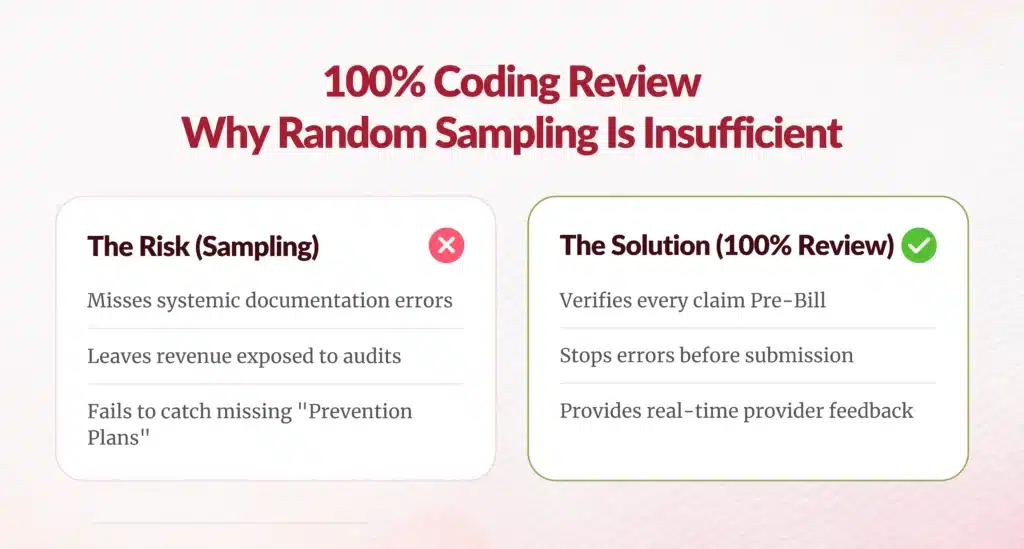

Why 100% Coding Review Is Essential?

The Penn State Health settlement underscores a critical truth: sampling-based auditing is insufficient for AWV services. Here’s why every single AWV claim should undergo coding review:

1. Complex Documentation Requirements

Unlike straightforward evaluation and management (E/M) services, AWVs require multiple specific elements that must be explicitly documented. A coder reviewing the record can identify missing elements before the claim is submitted.

2. High Error Rates

Even experienced providers often confuse AWVs with IPPEs or annual physicals. Without a 100% review, these errors go undetected until an external audit or government investigation.

3. Significant Financial Exposure

As Penn State Health learned, improper AWV billing can result in multi-million dollar settlements. The cost of a 100% coding review is minimal compared to the potential liability.

4. Provider Education Opportunities

Regular coding review creates feedback loops. When coders identify documentation deficiencies, they can provide real-time education to providers, preventing future errors.

5. Personalized Prevention Plans Are Often Missing

The personalized prevention plan is a required element that’s frequently overlooked or inadequately documented. This single omission can invalidate an otherwise well-documented visit.

6. Timing and Frequency Violations

Coders can verify eligibility and ensure AWVs aren’t billed:

- Within 12 months of an IPPE

- More than once per year

- Within 12 months of a previous AWV

AWV Compliance Documentation and Financial Protection

The Value-Based Care Paradox

As healthcare continues its shift toward value-based care, Medicare AWVs offer practices an opportunity to enhance patient health while capturing legitimate revenue. However, the service must be performed and documented correctly. The paradox is clear: the very service designed to improve preventive care becomes a compliance liability when documentation standards aren’t met.

Lessons from the Penn State Health Settlement

1. Self-Audit Regularly

PSH discovered the issue through internal review before a government audit. While the settlement was still substantial, self-disclosure likely reduced the penalty.

2. Invest in Coding Infrastructure

The cost of employing certified coders to review 100% of AWVs is negligible compared to an $11.7 million settlement.

3. Implement Pre-Bill Review

Claims should be reviewed before submission, not after payment is received. This prevents the need to refund improperly received payments.

4. Train Providers Specifically on AWV Documentation

Generic E/M documentation training isn’t sufficient. Providers need specific education on AWV requirements, particularly around personalized prevention plans.

5. Use Templates and Checklists

Electronic health record (EHR) templates should guide providers through each required AWV element, reducing the risk of omissions.

The Bottom Line

Penn State Health’s $11.7 million settlement wasn’t the result of a complex fraud scheme; it stemmed from insufficient clinical documentation for a single service line. For large health systems and medical groups, the message is clear: AWV coding requires 100% review by qualified coders who understand the specific documentation requirements.

The investment in comprehensive coding review is not just about compliance; it’s about protecting your organization from devastating financial exposure while ensuring your patients receive the documented preventive care they deserve.

Don’t let one misstep cost millions. Implement 100% AWV coding review today.