wRVU-Based Compensation and Adjusting Contracts for 2026 Changes

What You Need to Know About wRVU-Based Compensation and Adjusting Contracts for 2026 Changes Right Now?

At the same time, CMS is increasing the Medicare conversion factor by roughly 3.3–3.8%, but this increase does not offset the wRVU losses for procedural and facility-based specialists.

For organizations that pay physicians based on:

- wRVUs

- Productivity thresholds

- Per-wRVU conversion rates

This means doctors will appear less productive even if they do the same work, and many will miss bonus and base-salary thresholds unless contracts are updated.

This is not theoretical. It is structural.

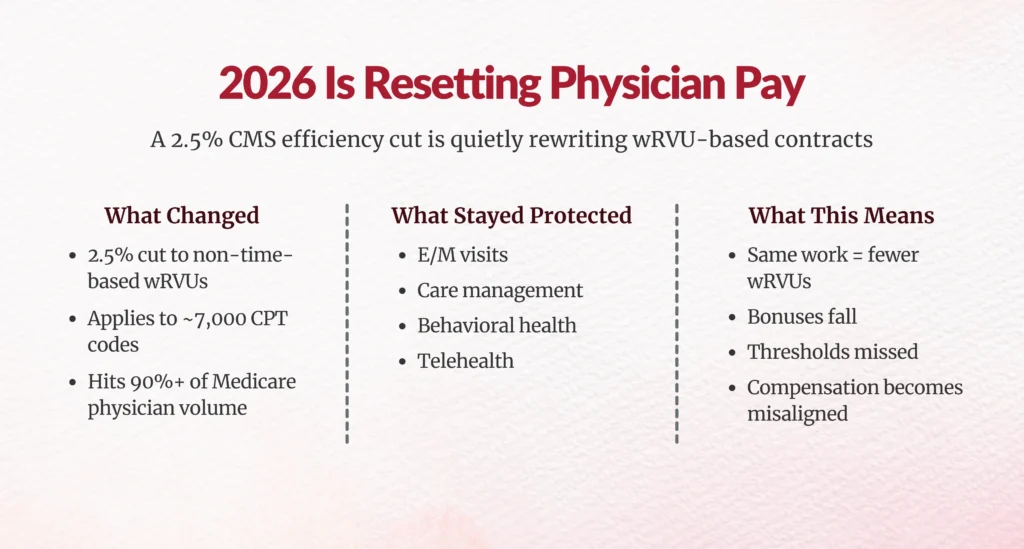

What exactly is changing in wRVU valuation in 2026?

CMS is introducing a permanent efficiency adjustment to the way physician work is valued.

Beginning January 1, 2026, CMS will reduce the intraservice work RVU and time for non-time-based CPT codes by 2.5%. This includes:

- Surgeries

- Diagnostic testing

- Imaging

- Interventional procedures

- Pathology services

- Procedural dermatology

- Most outpatient and inpatient technical services

This reduction will be repeated every three years, meaning this is not a one-time cut. It is a new valuation framework.

CMS justified this change by calculating that physician productivity has increased by 2.5% over five years, based on the Medicare Economic Index (MEI). Rather than adjusting payments upward for inflation and then reducing them through budget neutrality, CMS is now directly cutting work RVUs to reflect presumed efficiency.

This is the first time CMS has applied a systematic productivity haircut to physician labor.

Which services are protected?

CMS excluded all time-based services, including:

- Evaluation & Management (E/M)

- Chronic care management

- Behavioral health

- Medicare telehealth

- New CPT codes

- Maternity global codes

These services will not receive any efficiency reduction.

This creates a major specialty imbalance.

Primary care, psychiatry, and behavioral health remain protected.

But procedural specialists who generate the majority of hospital revenue are not.

Why this breaks wRVU-based compensation models

Most compensation contracts assume wRVUs are a neutral productivity unit.

They are not anymore.

In 2026, a surgeon can perform the same number of cases, generate the same hospital revenue, and deliver the same clinical value yet their measured wRVUs will be lower.

That triggers:

- Missed productivity floors

- Reduced bonus payouts

- Breach of minimum thresholds

- Artificial underperformance

You now have a valuation mismatch between actual clinical output and contractual productivity units.

This is the single biggest risk to physician-hospital alignment in 2026.

How much will physicians actually lose?

Let’s look at a simplified example.

A cardiologist produces 10,000 wRVUs, of which 80% are procedural.

CMS reduces those procedural wRVUs by 2.5%.

That physician now generates:

10,000 × 0.8 × (1 − 0.025) = 7,800 wRVUs

Plus 2,000 protected E/M wRVUs

= 9,800 total wRVUs

They just lost 200 wRVUs on paper without changing behavior.

At a $33.40 conversion factor, that is $6,680 per year in compensation erosion.

For high-volume surgeons, that number can exceed $20,000–$40,000 annually.

Will the higher conversion factor offset this?

Partially but not reliably.

CMS increased the conversion factor to:

- $33.57 for APM participants (+3.77%)

- $33.40 for non-APM (+3.26%)

But remember: the 2.5% wRVU cut applies first.

For physicians whose work is dominated by procedures, the net effect is often negative.

Worse, the 2.5% conversion factor boost expires in 2027, creating a massive cliff risk for multi-year contracts.

You cannot build physician compensation on a one-year political patch.

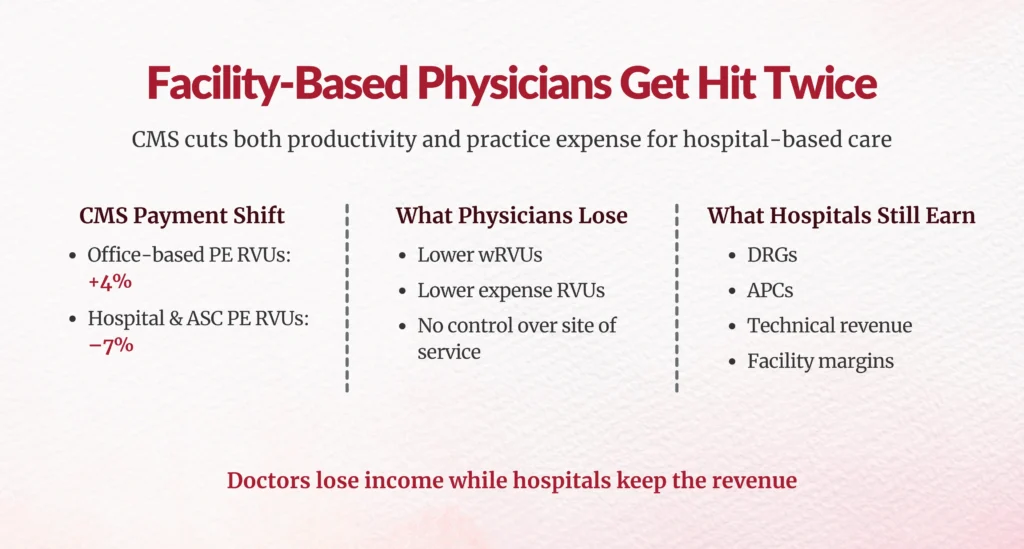

How facility-based physicians get hit twice

CMS also changed how practice expense RVUs are allocated.

- Office-based services: +4%

- Facility-based services (hospital, ASC): –7%

This means hospital-employed physicians get:

- Lower wRVUs

- Lower practice expense RVUs

- No control over the site of service

A cardiologist doing a stent in a hospital now generates 8–19% fewer RVUs than the same work in an office setting.

Yet the hospital still earns the DRG, APC, and technical revenue.

This creates massive alignment risk if compensation contracts are not rebalanced.

What contracts are most exposed?

You should immediately audit any agreement that includes:

- “wRVUs”

- “CMS RVU schedule”

- “Medicare valuation”

- “Conversion factor”

- “Productivity threshold”

- “Evergreen CMS updates”

These exist in:

- Employment agreements

- Independent contractor agreements

- Medical director contracts

- Teaching and academic agreements

- Call-pay formulas

- Coverage agreements

Most of them were written under pre-2026 assumptions.

Five contract strategies smart organizations are using

Option 1 – Lower wRVU thresholds

If the target was 8,000 wRVUs, lower it to 7,800. This preserves pay while keeping productivity logic intact.Option 2 – Increase per-wRVU rate

Increase the conversion factor by 2.5% so each RVU is worth more. This keeps benchmarks stable.Option 3 – Increase base salary

Move the lost variable compensation into guaranteed income. This stabilizes recruitment and retention.Option 4 – Carve out CMS efficiency cuts

Use pre-2026 RVUs for compensation while CMS uses adjusted RVUs for payment.

This decouples policy from payroll.

Option 5 – Move to blended compensation

Add:

- Quality

- Access

- Care coordination

- Clinical Documentation

- Value-based metrics

This future-proofs compensation.

Why HIM, CDI, and RCM leaders are now in the middle

This is not just a finance problem.

Your coding, documentation, and charge capture teams now determine whether physicians:

- Meet compensation thresholds

- Qualify for bonuses

- Appear productive

- Remain compliant

In 2026, every missing CC, modifier, procedure detail, and documentation gap becomes a compensation risk.

Expect:

- More physician disputes

- More audit scrutiny

- More contract challenges

Your revenue integrity infrastructure must be ready.

What should you do this quarter?

- Run CPT-level modeling using 2025 data

- Identify who loses RVUs

- Quantify dollar impact

- Update contracts before Jan 1

- Document fair market value using MGMA and AMGA benchmarks

- Prepare for 2027 cliff risk

Final Word for Leaders

CMS has permanently altered how physician labor is valued.

If you do nothing, your contracts will quietly break.

If you act now, you can:

- Protect physician income

- Maintain compliance

- Preserve alignment

- Avoid litigation

- Stabilize recruitment

2026 is not a reimbursement year. It is a contract reset year.

FAQs

What exactly is the 2026 Medicare wRVU efficiency adjustment and why does it matter?

CMS applies a –2.5% reduction to work RVUs and intraservice time for non-time-based CPT codes, reflecting productivity gains; it permanently alters ~90% of physician services, breaking wRVU-based contracts.

How will the 2.5% reduction in wRVUs affect physician compensation models in 2026?

Physicians generate fewer wRVUs for same work (e.g., 200 fewer on 10,000 base), missing thresholds and eroding pay by $6K–$40K annually unless contracts adjust.

Why do procedural specialists lose more compensation than primary care clinicians under the new wRVU rules?

Procedural codes (90% affected) lose 2.5% wRVUs, while primary care E/M time-based services are exempt, creating specialty imbalance.

What parts of wRVU valuation are exempt from the 2026 efficiency adjustment?

Time-based services exempt: E/M, care management, behavioral health, telehealth, maternity global periods.

How should healthcare organizations adjust physician contracts to prevent unintended pay cuts?

Options: lower wRVU thresholds, raise per-wRVU rate by 2.5%, boost base salary, carve out CMS cuts, or blend with quality/access metrics.

What compensation models reduce reliance on wRVUs and future-proof physician pay?

Blended models adding quality, access, care coordination, CDI, value-based metrics to stabilize against RVU volatility.

How does the 2026 CMS conversion factor update interact with the wRVU changes?

Conversion factor rises ~3.3–3.8% but doesn't fully offset 2.5% wRVU cut for procedural-heavy practices; boost expires 2027.

Why are facility-based physicians more economically impacted by the new RVU changes?

Facility PE RVU reallocation cuts 8–19% more RVUs vs. office settings, despite hospitals retaining DRG/APC revenue.

What tools or analyses can organizations use to model 2026 wRVU impacts before contract renewal?

Audit contracts with procedural wRVU %, model 2.5% cuts per specialty, simulate thresholds using CMS RVU files.

What risks do misaligned wRVU contracts pose for physician productivity, retention, and compliance?

Lower perceived productivity triggers bonus misses, erodes retention, strains alignment, heightens coding/CDI scrutiny risks.

Author Bio:

Kanar Kokoy

CEO - Chirok Health

Healthcare CEO & CDI/RCM innovator. I help orgs boost accuracy, integrity & revenue via truthful clinical docs. Led transformations in CDI, coding, AI solutions, audits & VBC for health systems, ACOs & more. Let’s connect to modernize workflows.