2026 Benchmark Data Reveals Why Post-Bill Coding Is Failing Specialty Practices

Why Relying on Post-Bill Coding Is Costing You More Than You Realize?

If your organization is still relying on post-bill coding reviews to catch errors after claims go out, the 2026 benchmark data sends a clear message: that approach is quietly costing you revenue, time, and credibility with payers.

Post-bill coding used to work. When payer edits were simpler and audits were slower, correcting claims after submission felt manageable. In 2026, that safety net is gone. Claims are adjudicated by algorithms, not humans, and once a denial hits, you’re already behind.

For healthcare leaders, this isn’t a theoretical problem. It’s showing up in denial rates, days in A/R, staff burnout, and missed revenue, month after month.

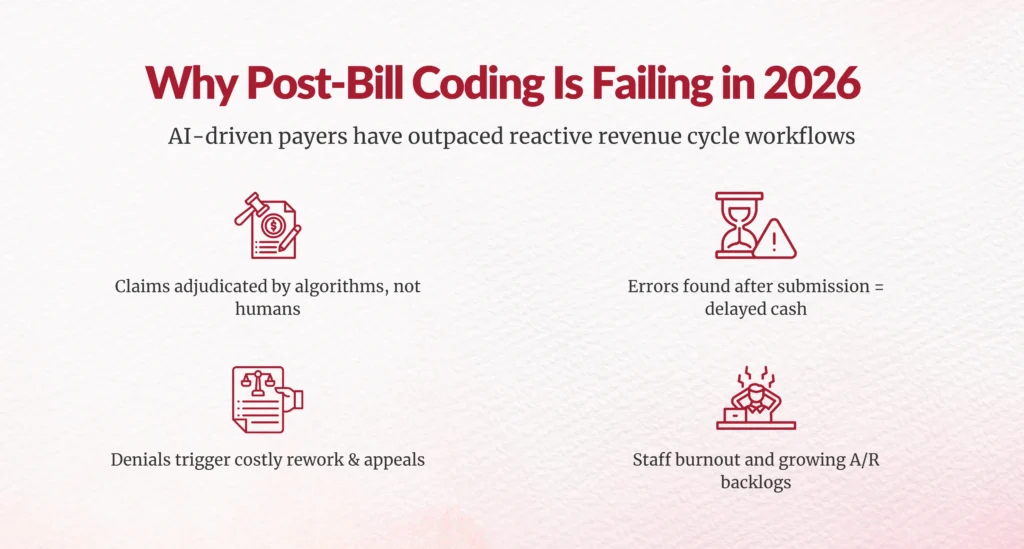

Why Is Post-Bill Coding No Longer Working in 2026?

Because the rules of reimbursement have changed fast.

Today’s payers rely on AI-driven claim edits, NLP-based documentation review, and real-time utilization analytics. These systems don’t wait for appeals. They make decisions instantly, based on what’s in the record at the time of submission.

When coding issues or documentation gaps are discovered after billing:

- Cash flow is immediately delayed by 30–60 days

- Appeal success rates drop significantly

- Clinical staff are asked to “fix” documentation long after the encounter

- Revenue cycle teams are pulled into costly rework

HFMA estimates that denial-related rework now consumes up to 15% of net patient revenue in underperforming organizations

That’s not a coding failure. It’s a process failure.

What Do 2026 Revenue Cycle Benchmarks Reveal About the Problem?

Benchmarks tell the story more clearly than anecdotes ever could.

When you compare high-performing specialty practices to industry averages, the difference isn’t just performance; it’s philosophy.

Key 2026 RCM Benchmarks

| Metric | High Performers | Industry Average | Common Failure Trigger |

|---|---|---|---|

| Denial Rate | <5% (<2% elite) | 6–13% (15–20% private payers) | Coding & documentation gaps |

| Days in A/R | <40 days | 33–50+ days | Slow follow-up, payer delays |

| First-Pass Resolution | >85% | 70–85% | Eligibility and coding mismatches |

| Net Collection Rate | >95% | <90% | Underpayments, write-offs |

If your organization consistently falls near the industry average, post-bill coding is likely masking upstream issues rather than solving them.

Why First-Pass Resolution Matters More Than Ever?

First-pass resolution is the clearest indicator of revenue cycle health, and it’s where post-bill models struggle the most.

When first-pass rates drop below 80%, several things happen:

- Staff spend more time reworking claims than preventing errors

- Payers flag the organization as “high-touch”

- Cash flow becomes unpredictable

- Leadership loses confidence in forecasts

High-performing organizations protect first-pass resolution aggressively, because they understand a simple truth:

Every claim that fails on first pass costs more to fix than to prevent.

How Expensive Are Denials Really in 2026?

More expensive than most leaders realize.

According to a recent analysis, the average cost to rework a denied claim is $57, and that number can exceed $100 for specialty claims involving authorizations or medical necessity appeals

Now layer in:

- Multiple touches per claim

- Delayed reimbursements

- Increased write-offs

- Lost staff productivity

Post-bill coding doesn’t reduce this cost, it normalizes it.

Why Specialty Practices Are Hit Harder Than Primary Care?

Specialty billing leaves little margin for error.

Unlike primary care, specialty claims often involve:

- High-dollar procedures

- Multiple modifiers

- Complex bundling rules

- Payer-specific medical necessity criteria

This means even small documentation or coding gaps can trigger high-value denials.

Where Payers Are Applying the Most Pressure?

Oncology and Nephrology

High-cost drugs, infusions, and chronic condition management are under intense scrutiny. CMS has expanded post-payment audits in these areas year over year

Orthopedics and Surgical Specialties

Modifier misuse (-59, -25, -57) remains a top audit trigger. The HHS Office of Inspector General continues to flag orthopedic claims as high risk

Behavioral Health

Updated E/M guidelines and telehealth rules have increased audit activity, particularly around time-based documentation.

Across specialties, AI-driven payer denials for high-cost services now reach 18–20% when pre-bill validation is absent.

Why CPT and ICD-10 Changes Make Post-Bill Coding Riskier?

Coding updates in 2026 are not minor tweaks—they are structural changes.

Recent updates include:

- New behavioral health CPT codes

- Expanded chronic condition ICD-10 classifications

- Revised E/M documentation thresholds

- Ongoing risk adjustment refinements

Without continuous education and real-time validation, post-bill coders are often correcting claims based on outdated assumptions.

AHIMA reports that coding education gaps contribute to a 12–18% increase in preventable denials in specialty settings.

Why Documentation Is the Breaking Point for Post-Bill Models?

Documentation used to support billing.

Now it drives reimbursement decisions.

Payers increasingly rely on NLP tools to assess:

- Medical necessity

- Severity of illness

- Modifier justification

- Risk adjustment accuracy

If clinical intent isn’t clearly documented at the point of care, no post-bill correction can fix it.

This is why organizations with strong CDI integration outperform peers relying solely on post-bill coding.

How Staffing Shortages Are Making Post-Bill Coding Unsustainable?

You’re likely feeling this pressure already.

The American Hospital Association reports that more than 30% of HIM and coding positions remain vacant or understaffed

The impact is real:

- Backlogs in post-bill reviews

- Inconsistent specialty expertise

- Higher error rates under time pressure

- Increased burnout and turnover

Post-bill coding becomes a reactive bottleneck, not a quality safeguard.

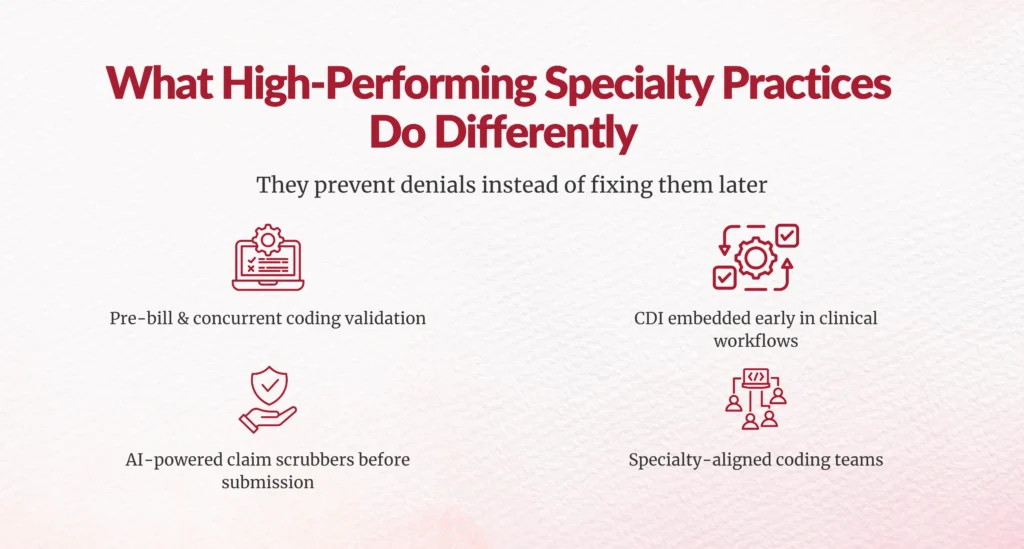

What Are High-Performing Specialty Practices Doing Instead?

They’re shifting upstream.

Top-performing organizations are:

- Auditing coding accuracy before submission

- Embedding CDI earlier in specialty workflows

- Using AI-powered claim scrubbers

- Aligning coders by specialty, not volume

The result:

- Denial rates consistently below 5%

- Net collection rates above 95%

- Faster cash flow

- Fewer appeals and write-offs

They’ve stopped treating post-bill coding as a fix, and started treating pre-bill accuracy as a strategy.

What Should You Do Next as a Revenue Cycle Leader?

If you’re leading CDI, HIM, or revenue cycle strategy, the question isn’t whether post-bill coding is failing.

The real question is: how long can you afford to rely on it?

Start by:

- Reviewing denial trends tied to documentation gaps

- Measuring first-pass resolution by specialty

- Identifying where post-bill rework is highest

- Evaluating concurrent coding and CDI integration

In 2026, revenue integrity isn’t about working harder after claims go out.

It’s about getting claims right the first time.

And the benchmark data makes one thing clear:

Post-bill coding alone can’t keep up anymore.

FAQs

1. What is post-bill coding, and why is it failing specialty practices in 2026?

Post-bill coding is the process of reviewing and correcting medical codes after a claim has already been submitted to the payer. In 2026, this approach is failing because claims are adjudicated using AI-driven payer edits and NLP-based documentation reviews. Once a denial occurs, correcting the claim becomes more expensive, time-consuming, and less likely to succeed, especially for complex specialty services.

2. How does post-bill coding impact denial rates and cash flow?

Post-bill coding increases denial rates because errors are identified too late in the process. Benchmark data shows organizations relying heavily on post-bill fixes experience denial rates between 6–20% and cash delays of 30–60 days. High-performing practices that focus on pre-bill accuracy consistently keep denials below 5% and improve cash predictability.

3. Why are specialty practices more affected than primary care?

Specialty practices deal with high-dollar procedures, complex CPT modifiers, and stricter medical necessity rules. Even minor documentation or coding gaps can trigger high-value denials. Payers also apply greater audit scrutiny to specialties like oncology, orthopedics, nephrology, and behavioral health, making post-bill corrections far less effective.

4. Can post-bill coding fix documentation issues after a claim is denied?

In most cases, no. Payers now use natural language processing (NLP) to assess medical necessity and clinical intent at the time of submission. If the documentation does not clearly justify the service, modifiers, or severity of illness upfront, post-bill coding cannot retroactively fix those gaps, leading to repeat denials or write-offs.

5. What benchmarks indicate that post-bill coding is no longer working?

Key warning signs include:

- First-pass resolution below 80%

- Denial rates above 5%

- Days in A/R exceeding 40–45 days

- Net collection rates below 95%

When these metrics trend toward industry averages, it often signals that post-bill coding is masking upstream workflow issues rather than preventing revenue loss.

6. What should revenue cycle leaders do instead of relying on post-bill coding?

Revenue cycle leaders should shift toward pre-bill and concurrent coding models, integrate CDI earlier in specialty workflows, and adopt AI-powered claim scrubbers. Organizations that take this approach reduce denials, accelerate cash flow, and protect revenue integrity, without increasing staff workload or burnout.

Author Bio:

Kanar Kokoy

CEO - Chirok Health

Healthcare CEO & CDI/RCM innovator. I help orgs boost accuracy, integrity & revenue via truthful clinical docs. Led transformations in CDI, coding, AI solutions, audits & VBC for health systems, ACOs & more. Let’s connect to modernize workflows.