7 High-Impact Payer Reimbursement Policy Decisions Influencing Claims, Audits & Cash Flow in 2026

Why do 2026 payer reimbursement policies matter right now?

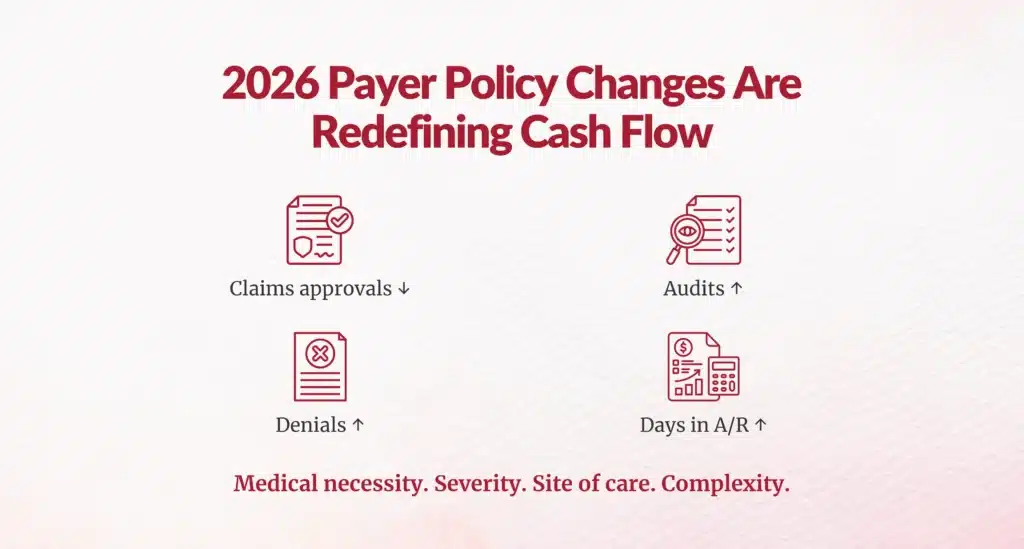

If you lead Clinical Documentation Integrity (CDI), HIM, Revenue Cycle, or Finance, here’s the reality you’re already feeling: payer reimbursement policy is no longer just a compliance issue, it’s a cash flow strategy.

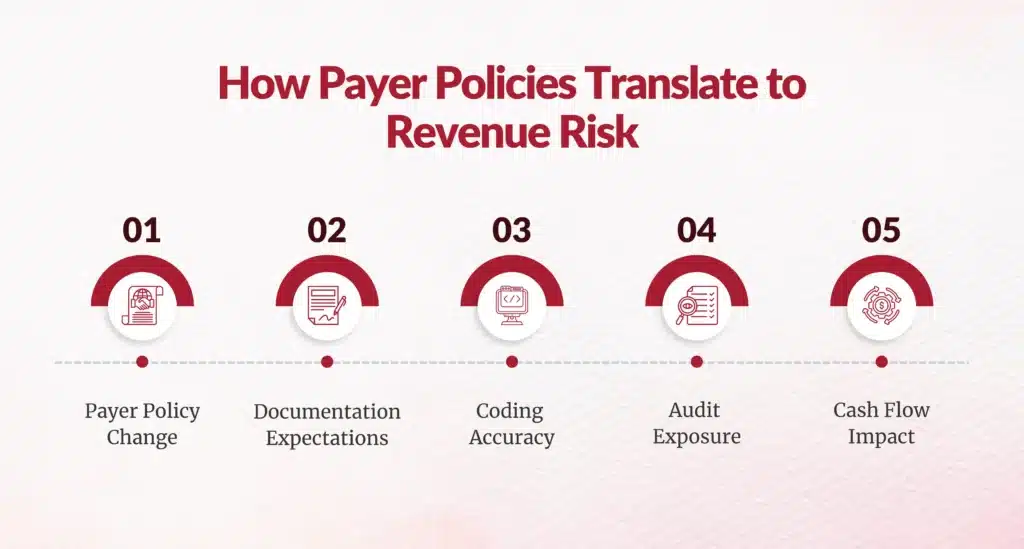

In 2026, major commercial and Medicare Advantage payers are tightening medical necessity definitions, redefining inpatient criteria, expanding code-level audits, and reshaping how severity, complexity, and site-of-care are reimbursed. These decisions will directly influence claims approval rates, audit exposure, denial volumes, and days in A/R.

According to the American Hospital Association, hospitals already spend $20+ billion annually on administrative costs tied to payer complexity and claim disputes, with denial-related rework accounting for a growing share of that burden.

Below, we break down seven of the most consequential payer reimbursement policy decisions for 2026, along with expert-level implications for documentation, coding, utilization management, and financial leadership.

1. How will BCBS North Carolina’s post-procedure inpatient determination impact utilization review?

Policy change:

Beginning February 2026, BCBS North Carolina will no longer approve inpatient status in advance for elective procedures under Medicare Advantage and D-SNP plans. Inpatient vs. outpatient determination will occur after the procedure, based on clinical condition.

Why this matters to you

This fundamentally shifts risk from the payer to the provider.

- Pre-service authorization no longer guarantees inpatient reimbursement

- Post-op documentation becomes the sole determinant of payment level

- Case management and CDI must align in real time, not retrospectively

Expert insight

2. Why is Cigna’s E/M downcoding policy a warning sign for all payers?

Policy change:

Cigna launched an automated downcoding policy affecting high-level E/M codes (99204–99205, 99214–99215, 99244–99245), adjusting claims that don’t meet complexity thresholds. While Cigna states 97% of providers will not be impacted, affected claims can be downcoded automatically.

What this signals

Even if your organization isn’t heavily impacted today, this is a template policy other payers are watching closely

- Medical decision-making (MDM) scrutiny is intensifying

- Time-based coding alone is no longer enough

- Payers are operationalizing CPT guidance at scale

3. How will UnitedHealthcare’s remote monitoring restrictions disrupt digital care strategies?

Policy change:

In 2026, UnitedHealthcare will exclude remote physiologic monitoring (RPM) coverage for Type 2 diabetes and most hypertension cases, while continuing coverage for heart failure and hypertensive disorders of pregnancy.

Why this is bigger than RPM

4. What does BCBS Massachusetts’ expanded high-complexity review mean for physician audits?

Policy change:

BCBSMA expanded claims review targeting providers who frequently bill level 4 and 5 visits. Only 1–2% of PCPs and 3–4% of specialists will be reviewed, but those selected face deeper scrutiny.

Why targeted audits are more dangerous

This is precision auditing, not blanket review.

- Peer benchmarking becomes central

- Outlier detection drives medical record requests

- Appeals depend on documentation sophistication

5. Why is Elevance Health penalizing out-of-network providers, and why should CFOs care?

Policy change:

Starting in 2026, Elevance (Anthem BCBS) will apply a 10% payment penalty for claims involving out-of-network providers under commercial plans in 11 states (excluding emergencies and pre-approved cases).

Financial impact

This policy directly affects:

- Hospital-based specialties (anesthesia, radiology, pathology)

- Network leakage costs

- Surprise billing exposure, despite No Surprises Act protections

6. How will Aetna’s expanded claims and code review increase documentation burden?

Aetna’s new claims review program may trigger medical record requests for:

- High-dollar claims

- Implants

- Anesthesia

- Bundled services

Why this matters operationally

Medical record requests increase:

- A/R days

- HIM labor costs

- Appeal backlog

AHIMA estimates that manual chart retrieval costs $25–$40 per record, excluding opportunity cost.

Without proactive documentation integrity, every high-dollar case becomes a downstream delay risk.

7. Why Aetna’s new inpatient severity payment policy could quietly erode margins?

Policy change:

Aetna will approve urgent/emergent inpatient stays lasting 1–4 midnights without medical necessity review, but reimburse them at lower severity rates, similar to observation.

The hidden risk

This creates a middle ground payment trap:

- Approved admission

- Reduced reimbursement

- No denial to appeal, just less revenue

What should CDI, HIM, and RCM leaders do next?

To navigate 2026 successfully, leading organizations are already:

- Embedding concurrent CDI into utilization review

- Aligning physician education with payer-specific audit logic

- Using analytics to identify coding outliers before payers do

- Treating payer policy monitoring as a financial strategy, not a compliance task

Are your teams ready for payer-driven reimbursement reality?

In 2026, payers are no longer reacting; they’re engineering reimbursement behavior. If your documentation, coding, and utilization strategies don’t evolve at the same pace, revenue erosion won’t show up as a denial. It will show up quietly, in downgraded payments, lost severity, longer A/R, and shrinking margins.

And by the time it’s visible on the financials, it’s already too late.

FAQs

What are the biggest payer reimbursement policy changes affecting healthcare revenue in 2026?

BCBS NC post-procedure inpatient decisions, Cigna automated E/M downcoding, UnitedHealthcare RPM restrictions, BCBSMA high-complexity audits, Elevance 10% out-of-network penalties, Aetna claims reviews/inpatient severity policies.

Why are payers tightening medical necessity and severity criteria in their reimbursement policies?

Payers engineer reimbursement behavior through tighter definitions, post-procedure validation, automated downcoding to control costs, reduce overutilization amid $20B+ admin burdens.

How do payer reimbursement policy decisions affect inpatient vs. outpatient reimbursement?

BCBS NC shifts inpatient determination post-procedure based on clinical condition; Aetna pays short-stay (1-4 midnights) at observation-like rates unless severity documented.

How does automated E/M downcoding by payers like Cigna impact provider claims outcomes?

Automatically adjusts high-level E/M codes (99204-99215) not meeting complexity thresholds; signals template for others, E/M errors = 30% outpatient audit findings.

What documentation or coding practices reduce the risk of payer severity reviews?

Post-op severity documentation, defendable complexity in E/M, precise medical necessity narratives, severity-specific coding beyond length-of-stay focus.

Why are payers expanding targeted audit reviews, and how should organizations prepare?

Precision auditing targets top 1-4% high-level billers (BCBSMA); OIG flags E/M upcoding; prepare via peer benchmarking, CDI education, documentation defensibility.

What are the financial risks of out-of-network provider penalties under new payer policies?

Elevance 10% payment cuts on commercial claims with out-of-network providers in 11 states (non-emergent); affects 1-in-5 inpatient stays per KFF.

How can revenue cycle teams proactively monitor payer reimbursement policy updates?

Track policy bulletins, align documentation/coding education, audit high-risk areas (E/M, severity), integrate payer rules into claim scrubbing.

How do new payer policies affect digital health reimbursement such as remote monitoring?

UnitedHealthcare excludes RPM for Type 2 diabetes/hypertension (covers HF/pregnancy); questions ROI/overutilization after 10x growth raises skepticism.

What role do analytics and documentation integrity play in adapting to evolving payer policies?

Analytics track peer benchmarks/audit risk; CDI ensures severity/complexity defensibility against downcoding, post-procedure validation, targeted reviews.

Author Bio:

Kanar Kokoy

CEO - Chirok Health

Healthcare CEO & CDI/RCM innovator. I help orgs boost accuracy, integrity & revenue via truthful clinical docs. Led transformations in CDI, coding, AI solutions, audits & VBC for health systems, ACOs & more. Let’s connect to modernize workflows.