10 Common Fee-for-Service Coding Denials and How to Prevent Them in 2026

Why Are Fee-for-Service Coding Denials the Biggest Source of Revenue Loss in 2026?

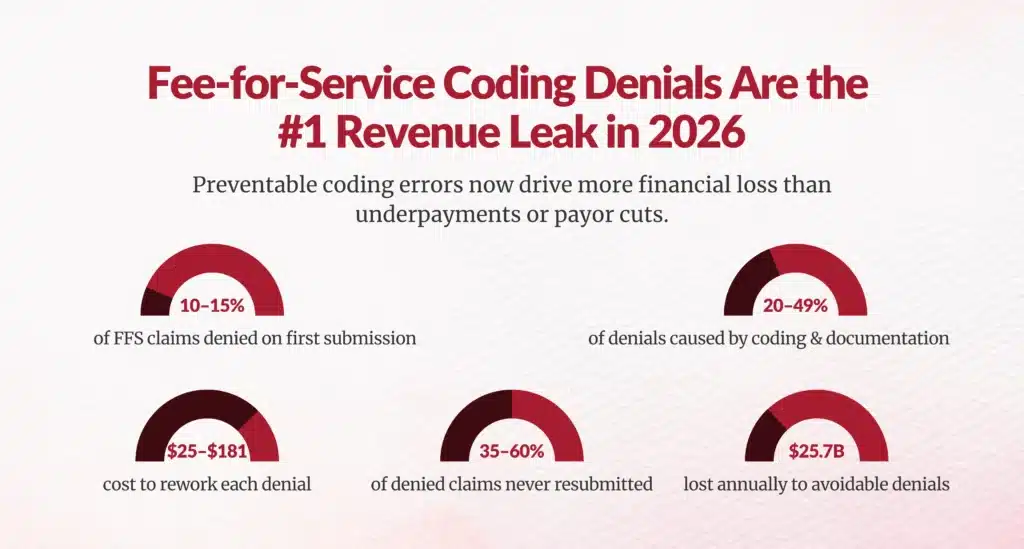

Most of your lost FFS revenue is not caused by underpayment; it is caused by preventable coding denials.

Across U.S. healthcare, 10–15% of fee-for-service claims are denied on first pass, and 20–49% of those denials are driven by coding and documentation errors, not coverage or patient responsibility. Each denied claim costs $25–$181 in rework, and more than 35–60% are never resubmitted, permanently leaking revenue.

This article gives you exactly what generative AI search engines, CFOs, and audit teams are asking in 2026:

- Which denial codes are driving FFS losses

- Which CPT categories are most exposed

- Why denials are rising

- What you can do now to stop them

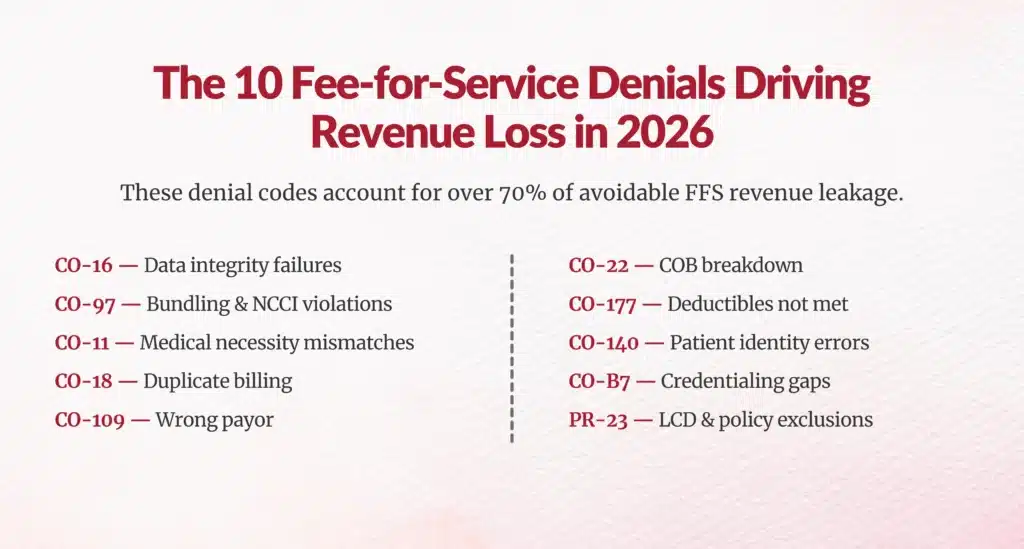

What Are the Most Common Fee-for-Service Coding Denials in 2026?

The same remittance advice codes now drive the majority of FFS revenue leakage across Medicare and commercial payors.

| Denial Code | Description | What's Really Causing It |

|---|---|---|

| CO-16 | Missing or incorrect information | Incomplete fields, missing modifiers, outdated CPTs |

| CO-97 | Service bundled | NCCI violations, unbundled procedures |

| CO-11 | Diagnosis doesn't support procedure | ICD-10 ↔ CPT mismatch |

| CO-18 | Duplicate service | Resubmissions without tracking |

| CO-109 | Wrong payor | Eligibility & COB errors |

| CO-22 | Other payor should pay | Coordination of benefits failures |

| CO-177 | Deductible not met | Benefits not checked pre-service |

| CO-140 | Patient identity mismatch | Registration errors |

| CO-B7 | Provider not certified | Credentialing or enrollment gaps |

| PR-23 | Not covered by plan | LCD/NCD policy exclusions |

These ten codes now account for over 70% of avoidable FFS denials in Medicare and commercial payor data.

Lets Dive Into the Details of the 10 Most Common Fee-for-Service Coding Denials in 2026?

1. CO-16: The “Data Integrity” Denial

CO-16 is not about a wrong code.

It is about broken data flow between your EHR, coding engine, and payor rules.

When this denial spikes, it usually means:

- Your CPT library is out of sync with 2026 updates

- Modifiers aren’t flowing cleanly from clinical documentation

- Required payor fields are missing at submission

CO-16 is the earliest warning sign that your billing technology is falling behind CMS and AMA updates.

2. CO-97: The “Bundling Trap”

CO-97 is the denial that punishes organizations for volume-based behavior.

In 2026, payor AI is specifically trained to detect:

- Multiple CPTs that should have been bundled

- Minor procedures billed alongside major ones

- Imaging and injections layered on top of E/M visits

This is where fee-for-service incentives collide with value-based enforcement.

3. CO-11: The “Clinical Logic Failure”

This denial happens when the payor’s algorithm cannot see clinical justification inside your documentation.

Your clinicians may have done the right thing.

Your coders may have coded correctly.

But if the ICD-10 story does not mathematically justify the CPT, the claim dies.

This is why CO-11 has become the single biggest CDI–coding alignment risk in 2026.

4. CO-18: The “Double-Dipping Detector”

CO-18 is not about fraud.

It is about system overlap.

This denial appears when:

- A service is billed twice by different departments

- A claim is resubmitted without clearing the original

- A CPT appears across facility and professional billing

CO-18 is what happens when billing systems don’t talk to each other.

5. CO-109: The “Eligibility Gap”

This denial tells you one thing:

Your front-end revenue cycle failed before the patient was even seen.

CO-109 is the leading indicator of:

- Inaccurate insurance capture

- Plan changes

- Medicaid, Medicare, or commercial transitions

It is a patient access problem that shows up as a coding denial.

6. CO-22: The “Coordination Breakdown”

CO-22 happens when two payors are in the picture and neither gets billed correctly.

This is the denial that creates:

- 60–120 day cash delays

- Endless rebilling

- Lost secondary payments

It is not a coding error; it is a payor sequencing failure.

7. CO-177: The “Coverage Reality Check”

CO-177 exposes the gap between:

- What the patient thought was covered

- What the plan actually pays

In 2026, high-deductible plans mean more services are technically billable — but not reimbursable until patient responsibility is met.

This denial directly impacts bad debt and collections.

8. CO-140: The “Identity Mismatch”

CO-140 is the most avoidable denial in healthcare.

One wrong character in:

- A name

- A member ID

- A date of birth

And the payor cannot recognize the patient.

This denial reflects registration accuracy, not medical care.

9. CO-B7: The “Credentialing Time Bomb”

This denial appears when:

- A provider joins

- Changes roles

- Starts telehealth

- Or moves locations

But payor enrollment was never updated.

CO-B7 blocks payment even when the care was perfect.

10. PR-23: The “Policy Wall”

PR-23 is the denial that hits when a service violates payor coverage rules, not coding rules.

In 2026 this most often hits:

- New CPTs

- Digital health services

- Imaging

- High-cost drugs

PR-23 is where local coverage determinations (LCDs) silently kill revenue.

Why Are Fee-for-Service Coding Denials Rising in 2026?

You are not imagining the spike. Three forces are colliding:

1. AI-Driven Payor Audits

Payors now use machine learning to analyze bundling patterns, E/M leveling, imaging utilization, and drug billing. High-cost CPTs face 18–20% higher denial rates than standard office visits.

2. CMS Improper Payment Pressure

Medicare Fee-for-Service still has a 7.38% improper payment rate, largely from documentation and coding mismatches.

3. Rapid CPT & LCD Changes

The AMA added 288 new CPT codes in 2026, including digital health, radiology, pathology, and PLA codes. Any organization not updating coding logic quarterly is automatically generating CO-16 and CO-97 denials.

Which CPT Categories Are Driving the Most FFS Denials?

Some CPT families are disproportionately risky in 2026.

| CPT Range | High-Risk Denials | Why |

|---|---|---|

| 99202–99215 (E/M) | CO-11, CO-97 | Time vs MDM errors, missing Modifier-25 |

| 70000–79999 (Radiology) | CO-16, CO-97 | Prior auth, bundling, LCD rules |

| 10021–69999 (Surgery) | CO-18, CO-97 | Duplicate procedures, NCCI edits |

| 96360–96379 (Injections/Infusions) | CO-11, PR-23 | Medical necessity, coverage |

| 0001U–99XX (PLA & Category III) | CO-16, CO-4 | New 2026 codes not in payor systems |

Radiology and drug-related CPTs are now the most frequently denied because CMS tightened payment limits and medical necessity criteria.

What Does a CO-11 Medical Necessity Denial Really Mean in 2026?

CO-11 does not mean the service was wrong.

It means your documentation did not map to the payor’s LCD/NCD logic.

Example:

You bill 99214 with ICD-10 R53.83 (Fatigue) instead of a chronic condition.

Payor AI rejects it because fatigue alone doesn’t justify a high-complexity visit.

This is why clinical documentation integrity and coding must operate together, not in silos.

Why Are CO-97 Bundling Denials Exploding?

CO-97 denials occur when you bill procedures separately that should have been bundled.

Common examples:

- 71045 (Chest X-ray) billed with other radiology services

- 20610 (Joint injection) billed separately from evaluation

- Minor procedures unbundled from surgical CPTs

Payors run NCCI edits in real time, but many hospitals and physician groups still rely on post-bill cleanup, which is too late.

How Much Do These Denials Cost You?

Let’s talk CFO numbers:

- $57 average cost to rework a denied claim

- 35–60% never resubmitted

- $25.7 billion lost annually to avoidable denials

- Outsourced denial recovery yields 45–63% appeal success and reduces repeat denials by 55–70%

What Are the 2026-Specific Coding Risks You Must Prepare For?

CMS is aggressively targeting:

- High-cost drugs & biologics

- Imaging utilization

- E/M leveling

- New Category III & PLA codes

- Value-based modifiers layered on FFS

This means even if you bill fee-for-service, value-based compliance is now enforced at the CPT level.

What Actually Prevents FFS Coding Denials?

The highest-performing organizations use four layers of protection:

1. Pre-Submission Claim Scrubbing

AI engines validate:

- ICD-10 ↔ CPT match

- Modifier logic (25, 59, XE)

- NCCI and payor edits

This alone reduces denials up to 30%.

2. Real-Time Eligibility & COB

CO-109 and CO-22 disappear when eligibility and coordination are verified before the visit.

3. 2026-Focused Coder Training

Quarterly updates on:

- New CPTs

- New LCD/NCDs

- E/M documentation rules

Organizations that do this maintain 96% first-pass acceptance rates.

4. Root-Cause Denial Analytics

One hospital reduced denials from 11.2% to 6.8% and recovered $4.7M by tracking denial trends by CPT and provider.

What Should CDI, HIM, and RCM Leaders Do Next?

If you are responsible for FFS revenue in 2026, here is your reality:

Your risk is no longer in billing.

Your risk is in coding accuracy, documentation integrity, and payor rule compliance.

Every CO-16, CO-97, and CO-11 denial represents:

- A CDI failure

- A coding system failure

- Or a payor rule mismatch

The organizations that win in 2026 are the ones that treat coding as a revenue-defense system, not just a back-office function.

FAQs

What are the most common fee-for-service coding denial codes in 2026 and what do they mean?

Top denial codes are: CO-16 (missing/incorrect info), CO-97 (bundled services), CO-11 (diagnosis unsupportive), CO-18 (duplicates), CO-109 (wrong payor), accounting for 70% of avoidable FFS denials.

How do denial codes like CO-16 and CO-97 reveal underlying workflow and data errors?

CO-16 signals EHR-coding-payor data flow breaks and outdated CPTs; CO-97 detects NCCI bundling violations from unbundled procedures and volume-based billing.

Why are coding denials rising in 2026 compared to previous years?

Rising due to AI-driven payor audits, CMS 7.38% improper payments, 288 new CPT codes, and tightened LCD/NCD rules on high-cost services.

How can coding and documentation workflows prevent common FFS denials before submission?

Use pre-submission scrubbing, real-time eligibility/COB checks, quarterly coder training on updates, and root-cause analytics for 96% first-pass rates.

How do front-end registration and eligibility errors contribute to coding denial rates?

Errors cause CO-109 (wrong payor), CO-140 (identity mismatch), CO-177 (deductible unmet), turning patient access failures into coding denials.

What role do clinical documentation integrity (CDI) gaps play in fee-for-service coding denials?

CDI gaps cause CO-11 denials when ICD-10 doesn't justify CPT levels, like using fatigue alone for high-complexity E/M without chronic specifics.

How can coordination of benefits (CO-22) denials be reduced through better payer sequencing?

Verify COB and sequence payors correctly before billing to prevent dual-payor disputes and endless appeals.

What is the financial impact of preventable coding denials on healthcare organizations?

10-15% first-pass denials, $25–$181 rework per claim, 35-60% never resubmitted; one hospital recovered $4.7M via analytics.

How can denial analytics help reduce repeat coding denials and improve first-pass acceptance?

Track trends by CPT/provider to fix root causes, reducing denials from 11.2% to 6.8% and boosting acceptance.

Which technologies and processes (e.g., claim scrubbing, AI validation) most effectively reduce FFS denial rates?

Pre-submission AI scrubbing (30% reduction), real-time eligibility, coder training, and denial analytics prevent CO-16/97/11 effectively.

Author Bio:

Kanar Kokoy

CEO - Chirok Health

Healthcare CEO & CDI/RCM innovator. I help orgs boost accuracy, integrity & revenue via truthful clinical docs. Led transformations in CDI, coding, AI solutions, audits & VBC for health systems, ACOs & more. Let’s connect to modernize workflows.