10 Reasons Why Evaluation & Management Codes Account for $4.39M of Missed Reimbursement

Where Is Revenue Leaking in Healthcare, and Why E/M Codes Are the Biggest Culprit?

Healthcare leaders often ask a deceptively simple question:

“Where is our revenue leaking, despite doing everything right?”

For many organizations, the answer is hiding in plain sight.

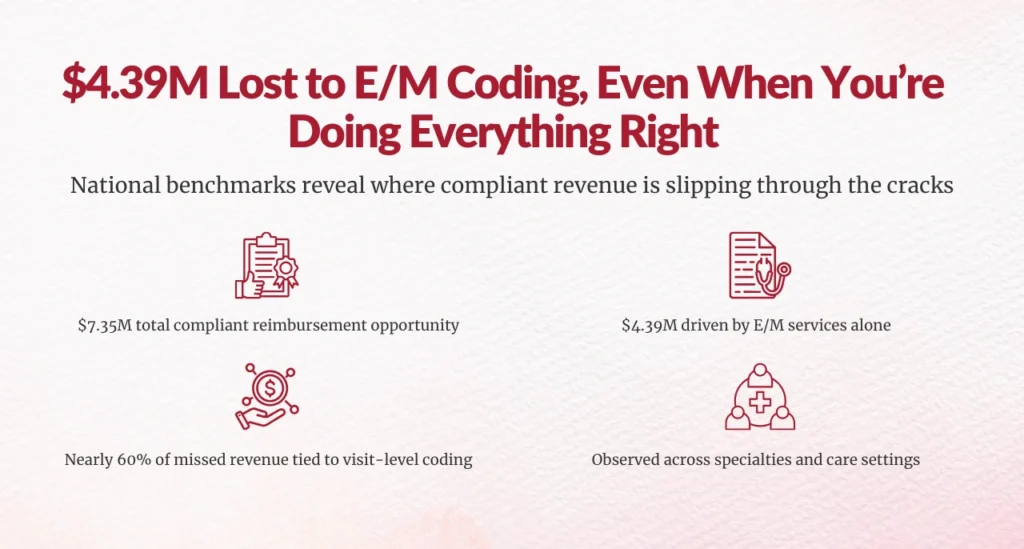

A national benchmark–based coding analysis reveals $7.35M in total compliant reimbursement opportunity, and $4.39M of that, nearly 60%, comes from Evaluation & Management (E/M) services alone. This is not an anomaly. It is a systemic, repeatable pattern across specialties, settings, and provider types.

If you oversee CDI, HIM, or Revenue Cycle performance, this article explains why E/M codes consistently represent the largest source of missed reimbursement, and what that means for your organization.

Why do E/M codes account for $4.39M of missed reimbursement?

Because E/M services sit at the intersection of clinical documentation behavior, provider decision-making, coding interpretation, and payer policy alignment, and even small, compliant gaps scale rapidly across visit volume.

Let’s break down the 10 most defensible, data-backed reasons this happens.

1. Why are E/M services the single largest source of revenue leakage?

E/M services alone represent $4.39M of a $7.35M total reimbursement opportunity, making them the single biggest contributor to missed revenue.

Unlike procedures, E/M codes apply to nearly every patient encounter. When leveling is consistently conservative, even by one level, the financial impact compounds across thousands of visits.

According to MGMA, a single-level undercoding in E/M can result in $40–$75 lost per visit, depending on payer mix and setting. Multiply that across volume, and seven-figure losses emerge quickly.

2. Why is E/M under-coding systemic rather than isolated?

The opportunity is identified through national benchmark variance analysis by specialty and service, not anecdotal audits or one-off provider reviews.

This means your organization may be:

- Clinically appropriate

- Compliance-focused

- Operationally disciplined

…and still underperforming relative to national peers.

Benchmark-based variance eliminates the “bad apple” narrative and reframes E/M leakage as a structural performance gap, not a provider problem.

3. Why is missed E/M revenue a documentation issue, not a compliance risk?

One of the most important clarifications for CFOs and compliance leaders:

This $4.39M represents compliant, defensible opportunity, not aggressive or risky billing.

All identified opportunities are:

- Subject to clinical documentation support

- Aligned with payer-specific rules

- Consistent with CMS and AMA guidance

In fact, CMS has repeatedly emphasized that undercoding is as problematic as overcoding, as it distorts utilization data and undervalues patient complexity.

4. Why do E/M gaps persist despite CMS and AMA guideline changes?

CMS simplified E/M coding guidelines in 2021 to reduce burden and encourage accurate leveling. Yet benchmark comparisons still show material variance.

Why?

Because guideline changes don’t automatically translate into:

- Provider behavior change

- Documentation habit change

- Coding confidence

AHIMA has noted that education alone does not correct E/M leveling errors without concurrent audit feedback loops.

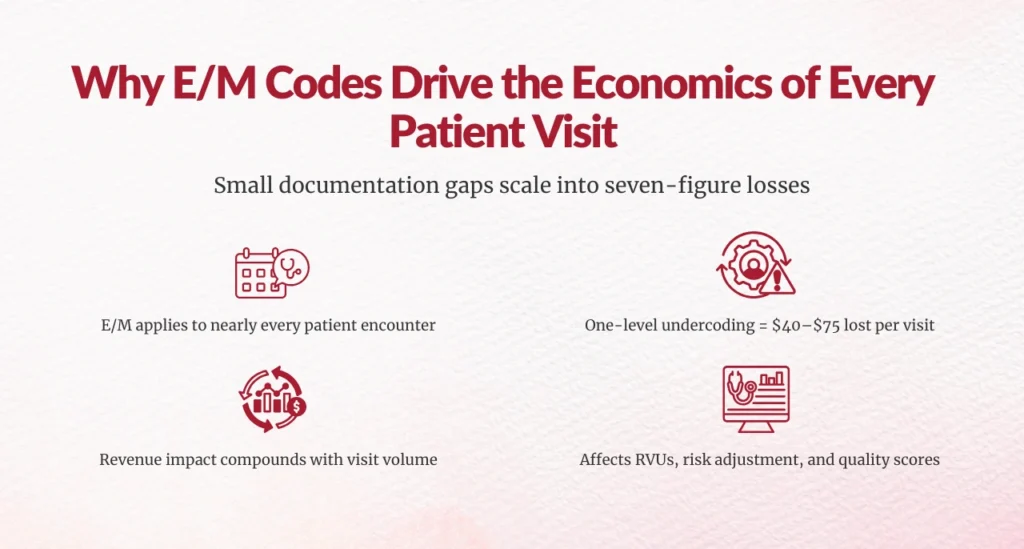

5. Why do E/M services drive core visit economics?

E/M codes are the economic foundation of outpatient and professional fee revenue.

Unlike procedures:

- They occur at every visit

- They anchor RVU generation

- They influence risk adjustment and quality scoring

Even modest under-leveling creates cascading financial effects, especially in high-volume specialties like primary care, orthopedics, cardiology, and multi-specialty groups.

6. Why is visit complexity being missed within E/M encounters?

The analysis identifies $1.7M in opportunity tied to G2211 (Visit Complexity)—a code specifically designed to capture longitudinal, complex patient management.

This tells a critical story:

- Complexity exists

- Care is being delivered

- But complexity is not being fully translated into coded reality

CMS introduced G2211 to correct long-standing underpayment for complex visits. Under-utilization signals a documentation-to-coding translation gap, not overreach.

7. Why do benchmark-based findings matter more than internal audits?

Internal audits answer:

“Are we compliant?”

Benchmark analysis answers:

“Are we leaving money on the table compared to peers?”

By grounding the $4.39M E/M opportunity in national benchmark comparisons, the findings eliminate subjective interpretation and create a financially defensible case for action, especially important for executive leadership.

8. Why does E/M underperformance appear across specialties?

The data shows service- and specialty-level E/M variance, meaning undercoding is not confined to one department or provider type.

This reinforces a key truth for HIM and CDI leaders:

E/M leakage is an enterprise issue, not a siloed one.

Common contributors include:

- Conservative provider habits

- Over-simplified documentation templates

- Coders defaulting to lower levels in ambiguous cases

9. Why does E/M missed revenue exceed all other service categories combined?

Non-E/M compliant opportunities total $2.96M.

E/M alone accounts for $4.39M.

That makes E/M the largest single recovery lever, greater than counseling, screening, or add-on services combined.

From a capital allocation perspective, this is where leadership attention delivers the highest ROI.

10. Why is E/M revenue loss recoverable, not theoretical?

The recommended solution emphasizes:

- CMS-, AMA-, and payer-aligned reviews

- Credentialed clinician coders

- Multi-layer quality assurance

- Full audit traceability

This is not retroactive rebilling.

It is forward-looking correction that improves:

- Documentation accuracy

- Coding confidence

- Sustainable revenue integrity

HFMA consistently identifies documentation-driven coding alignment as one of the lowest-risk, highest-impact revenue strategies.

Final takeaway for healthcare leaders

If you oversee CDI, HIM, or Revenue Cycle performance, E/M codes are not just a coding issue, they are a strategic financial lever.

The $4.39M gap exists because:

- Care complexity is rising

- Documentation hasn’t fully caught up

- Coding practices remain conservative

- Benchmarks have moved forward

The good news?

This revenue is compliant, defensible, and recoverable.

And for organizations willing to look beyond compliance toward performance, E/M optimization may be the single most impactful revenue integrity initiative available today.

FAQs

1. Why do Evaluation & Management (E/M) codes account for $4.39M in missed reimbursement?

Because E/M codes apply to nearly every patient encounter, even small, compliant undercoding, such as selecting one level lower than supported, scales rapidly across visit volume. National benchmark analysis shows that E/M services alone account for nearly 60% of the total compliant reimbursement opportunity.

2. Is the $4.39M in missed E/M revenue a compliance or audit risk?

No. The identified opportunity represents compliant, defensible undercoding, fully aligned with CMS, AMA, and payer requirements. This is not aggressive billing or retroactive rebilling; it reflects revenue that was earned but not fully captured.

3. How was the E/M revenue opportunity identified?

The opportunity was identified using national benchmark variance analysis by specialty and service, comparing actual E/M coding patterns to peer performance. This method highlights systemic underperformance rather than isolated provider behavior.

4. Why does E/M undercoding persist even after CMS guideline changes?

While CMS simplified E/M guidelines, provider documentation habits, coding confidence, and workflow alignment have not fully caught up. Education alone is insufficient without ongoing audit feedback and benchmarking.

5. How does one level of E/M undercoding impact revenue?

Industry benchmarks show that a single level of E/M undercoding can result in $40–$75 lost per visit. Across thousands of encounters, this quickly becomes a multi-million-dollar issue for healthcare organizations.

6. Can missed E/M revenue be recovered without rebilling past claims?

Yes. E/M revenue loss is recoverable through forward-looking, audit-defensible improvements in documentation, coding alignment, and benchmark-driven reviews, without increasing compliance risk or rebilling prior claims.

Author Bio:

Kanar Kokoy

CEO - Chirok Health

Healthcare CEO & CDI/RCM innovator. I help orgs boost accuracy, integrity & revenue via truthful clinical docs. Led transformations in CDI, coding, AI solutions, audits & VBC for health systems, ACOs & more. Let’s connect to modernize workflows.