How Revenue Cycle Directors Can Optimize Annual Wellness Visits for Better Reimbursement

How do Revenue Cycle Directors maximize reimbursement from Annual Wellness Visits (AWVs) in 2026?

If you are a Revenue Cycle Director, the short answer is this:

You maximize AWV reimbursement by combining compliant CPT billing, proactive eligibility verification, accurate risk adjustment capture, and denial-proof documentation, before the patient ever walks into the exam room.

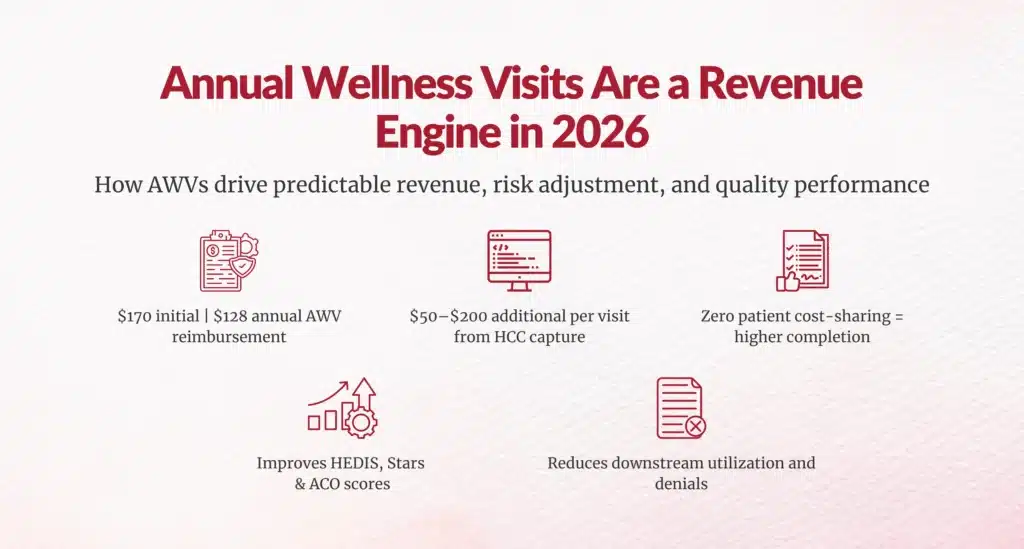

In 2026, AWVs remain one of Medicare’s highest-margin, lowest-cost preventive services, yet they continue to be underutilized and under-captured. When optimized correctly, AWVs drive:

- Predictable FFS revenue

- Higher Medicare Advantage risk scores

- Stronger quality metrics (HEDIS, Stars, ACO REACH)

- Lower downstream utilization

CMS data shows that only ~40–45% of eligible Medicare beneficiaries receive an AWV each year, leaving billions on the table for provider organizations

For you as a revenue leader, AWVs are not a clinical initiative.

They are a revenue integrity and risk adjustment engine.

What exactly gets reimbursed in an Annual Wellness Visit?

CMS reimburses AWVs using specific HCPCS and CPT codes:

| Code | Description | 2026 National Average* |

|---|---|---|

| G0438 | Initial AWV | ~$170 |

| G0439 | Subsequent AWV | ~$128 |

| 99497 | Advance Care Planning (30 min) | ~$80 |

| 99498 | Each additional 30 min ACP | ~$75 |

Now look at the math from a revenue-cycle lens:

- 500 AWVs × $128 = $64,000

- 50% include ACP × $80 × 250 = $20,000

- Total = $84,000 per year from one mid-size panel

That does not include:

- HCC risk score capture

- Quality incentive payments

- ACO shared savings

- Medicare Advantage RAF uplift

When you layer in risk adjustment, AWVs frequently generate $50–$200 more per visit in MA plans.

Why do so many AWV claims still get denied or underpaid?

From a revenue integrity standpoint, AWVs fail for three predictable reasons:

Eligibility is wrong

CMS allows:

- One initial AWV per lifetime

- One subsequent AWV every 12 months

Failure to validate the last billed date causes frequency denials.

CMS denial data shows that preventive services are among the top 10 denied claim categories due to eligibility and frequency errors

Documentation does not meet CMS requirements

An AWV must include:

- Health risk assessment

- Updated medical/family history

- Cognitive impairment screen

- Depression screening (PHQ-2 or PHQ-9)

- Fall risk assessment

- Personalized prevention plan

Missing any of these triggers downcoding or recoupment during audits.

HCCs are not captured

AWVs are the best setting to recapture chronic conditions because:

- Patients are stable

- Providers have time

- Documentation is reviewed

Yet many AWVs only document preventive checklists, not chronic disease specificity required for risk adjustment.

That is lost RAF revenue that never returns.

How do 2026 Medicare updates change AWV economics?

The 2026 Medicare Physician Fee Schedule was introduced:

- A 2.5% one-time conversion factor increase

- RVU refinements for preventive and cognitive care

- Higher Part B premium: $202.90/month

Importantly:

AWVs remain $0 cost-sharing for beneficiaries, meaning patient demand stays high even as deductibles rise to $283 in 2026.

This makes AWVs one of the few services where patient financial friction does not limit volume.

From a CFO perspective:

“AWVs become one of the safest revenue levers in Medicare.”

What workflows should Revenue Cycle Directors standardize?

High-performing systems use pre-visit, point-of-care, and post-visit controls.

Pre-visit controls (48 hours before the visit)

Your RCM team should:

- Run HIPAA 270/271 eligibility

- Verify last AWV date

- Flag HCCs due for recapture

- Pre-load AWV templates

This single step eliminates 70%+ of AWV denials in most systems

Point-of-care controls

Embed in Epic, Athena, or eClinicalWorks:

- PHQ-9

- Fall risk

- Cognitive screen

- ACP prompts

- HCC gap alerts

This allows the clinician to document once and bill everything.

Pre-bill scrubbing

Before claims go out:

- Run NCCI edits

- Separate E/M if medically necessary

- Validate preventive vs problem-oriented documentation

CMS explicitly states that improperly combined E/M and AWV claims trigger denials.

What KPIs should HIM and RCM leaders track?

If you are not tracking these, you are flying blind:

| KPI | Best-in-Class Target |

|---|---|

| AWV completion rate | >65% of eligible patients |

| Denial rate | <3–5% |

| Charge lag | <3 days |

| Days in A/R | <40 |

| HCC recapture rate | >85% of prior-year conditions |

Organizations that manage these have achieved 15–20% net revenue improvement on Medicare panels.

One multi-state system reported $97M in margin improvement after optimizing preventive and front-end revenue capture.

How are top systems scaling AWVs in 2026?

The biggest breakthrough is team-based AWVs.

RN- and NP-led AWVs

High-performing programs use:

- Nurses for screenings

- NPs for ACP

- Physicians for only complex decisions

One Medicare network reduced physician AWV time by 43% while increasing RN-led visits by 200%

That means:

- More provider capacity

- More AWV volume

- More revenue

Data-driven outreach

Using:

- MA plan gaps

- HCC missing codes

- Care gap lists

Systems have achieved 120% to 1,000% growth in AWV volume using automated outreach and self-scheduling.

What does this mean for you as a Revenue Cycle or HIM leader?

If you oversee:

- CDI

- HIM

- Coding

- Front-end revenue

- Risk adjustment

Then AWVs are one of the few workflows where all of your teams intersect in one encounter.

They touch:

- Eligibility

- Coding

- Documentation

- Risk adjustment

- Quality reporting

- Preventive care compliance

When you operationalize AWVs correctly, you do not just earn visit revenue; you stabilize your entire Medicare book of business.

Conclusion

In 2026, Annual Wellness Visits are no longer a “nice-to-have preventive service.”

They are a strategic revenue, compliance, and risk adjustment platform.

When Revenue Cycle Directors treat AWVs as a controlled revenue workflow instead of a clinical add-on, they unlock:

- $100K+ per 1,000 visits

- Higher RAF scores

- Lower denials

- Better audit protection

- Stronger quality performance

And that is exactly what healthcare finance leadership is being asked to deliver right now.

FAQs

Why does Medicare deny reimbursement for some Annual Wellness Visits even when eligibility is met?

Denials occur due to inadequate documentation missing CMS-required elements or failure to capture HCCs for risk adjustment, leading to downcoding or recoupment during audits.

What documentation elements are mandatory for Medicare to reimburse an Annual Wellness Visit?

Mandatory elements include personalized prevention plan, health risk assessment, cognitive screening, and chronic condition documentation to meet CMS requirements and avoid denials.

How do documentation gaps in AWVs lead to long-term revenue leakage?

Gaps prevent HCC recapture for risk adjustment, causing lost RAF revenue of $50–$200 per visit in MA plans that never returns.

What is the reimbursement difference between initial and subsequent Medicare Annual Wellness Visits?

Initial AWV (G0438) reimburses ~$170 nationally, while subsequent (G0439) reimburses ~$128, a ~$42 difference per 2026 averages.

How does incorrect AWV coding affect Medicare payments and compliance risk?

Incorrect coding, like improper E/M + AWV combos, triggers denials, downcoding, audits, and recoupments, increasing compliance risks.

Can incomplete risk assessments impact Annual Wellness Visit reimbursement?

Yes, incomplete assessments fail to capture HCCs, reducing risk adjustment revenue by $50–$200 per visit despite base AWV payment.

Why are Annual Wellness Visits a common trigger for Medicare audits?

AWVs trigger audits due to frequent eligibility/frequency errors, documentation gaps, and improper coding, ranking preventive services in CMS top 10 denials.

How does Medicare track Annual Wellness Visit frequency across providers and years?

Medicare tracks via last billed date; initial AWV allowed once per lifetime, subsequent once per year, with failures causing frequency denials.

What are the most common billing mistakes that reduce AWV reimbursement?

Common mistakes: wrong eligibility verification, missing CMS documentation, uncaptured HCCs, and improper E/M combinations before billing.

How can better clinical data capture improve Medicare AWV reimbursement outcomes?

Better capture ensures HCC recoupment (>85% target), reduces denials (<5%), and adds $50–$200 per visit in risk adjustment revenue.

Author Bio:

Kanar Kokoy

CEO - Chirok Health

Healthcare CEO & CDI/RCM innovator. I help orgs boost accuracy, integrity & revenue via truthful clinical docs. Led transformations in CDI, coding, AI solutions, audits & VBC for health systems, ACOs & more. Let’s connect to modernize workflows.