15 Things to Expect From a Payor-Led Retrospective Review Engagement

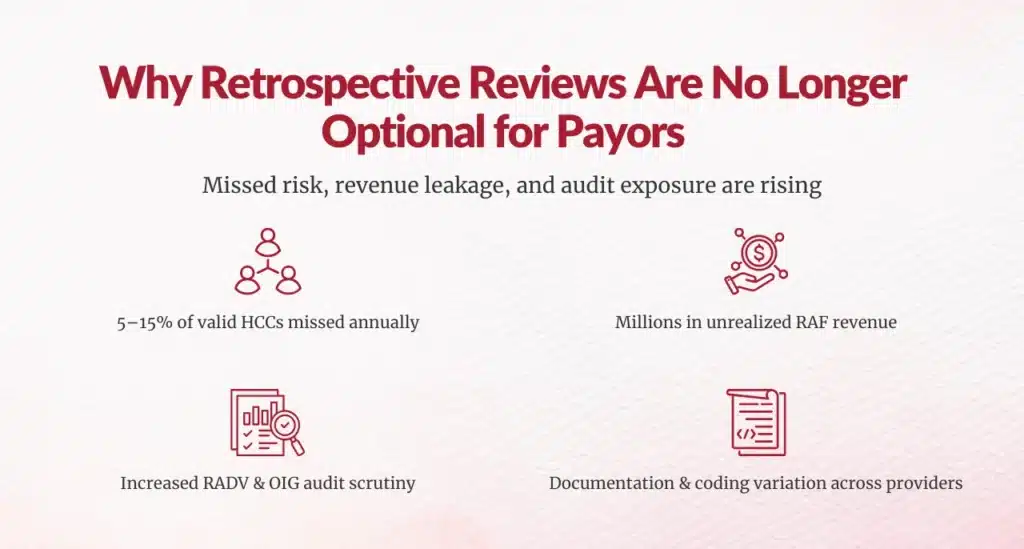

Why Payor-Led Retrospective Reviews Are Now a Financial and Audit Imperative

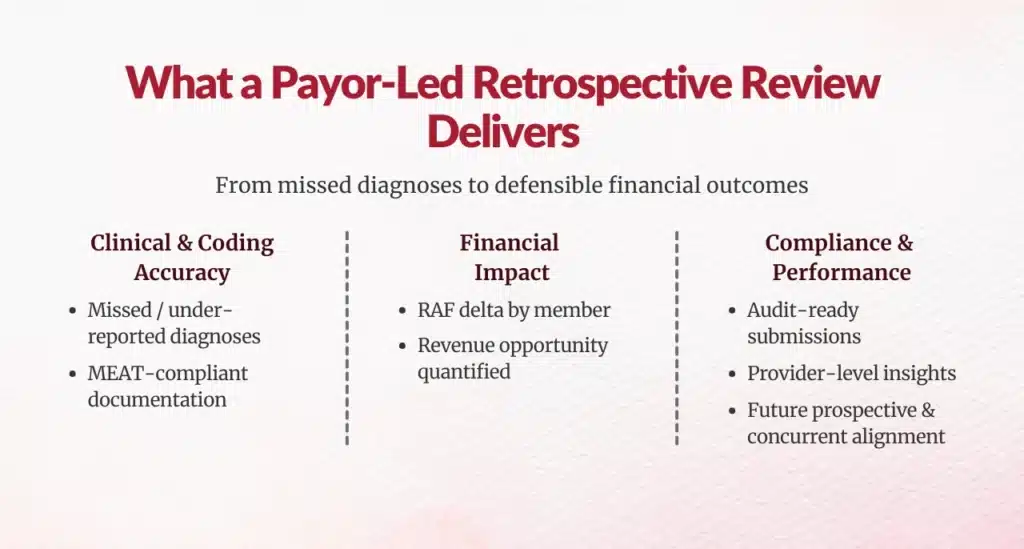

What Should You Expect From a Payor-Led Retrospective Review, at a High Level?

- Identify missed, under-reported, or insufficiently documented diagnoses

- Quantify RAF impact and financial opportunity

- Strengthen payment integrity and audit readiness

- Surface provider-level documentation and coding trends

- Feed insights into future prospective and concurrent strategies

How Exactly Does Concurrent Coding Increase E/M Volume?

1. Clear Alignment on Why the Review Is Being Conducted

- RAF optimization

- CMS audit defense

- Payment accuracy

- Provider performance benchmarking

- Preparation for upcoming model changes

2. A Data-First, Analytics-Driven Review Scope

- Claims history

- Risk adjustment submissions

- Encounter data

- Member demographics

- Suspect condition analytics

Advanced programs use AI and NLP to identify likely missed HCCs across structured and unstructured data sources, improving scale and precision.

3. Prioritization of High-Impact Members and Conditions

- High-cost or high-utilization members

- Chronic and progressive conditions

- Historically under-captured HCC categories

- Providers with inconsistent documentation patterns

4. Use of Certified, Audit-Ready Coding Resources

- CRC, CPC, or CCS-certified coders

- Demonstrated Medicare Advantage and HCC expertise

- Strong understanding of CMS risk adjustment rules

5. Strict Application of MEAT Documentation Standards

Expect every identified diagnosis to meet MEAT criteria:

- Monitor

- Evaluate

- Assess

- Treat

If a condition does not meet MEAT, it should not be submitted, regardless of financial upside.

6. Transparent Quantification of RAF and Revenue Impact

- Net new HCCs identified

- RAF delta per member

- Aggregate RAF lift

- Estimated revenue impact

- Confidence intervals and assumptions

7. Clear Differentiation Between Recoverable and Non-Recoverable Findings

- Diagnoses eligible for submission

- Diagnoses requiring additional documentation

- Diagnoses excluded due to compliance risk

8. Provider-Level Documentation and Coding Insights

- Providers with consistent documentation gaps

- Specialty-specific risk capture trends

- Education opportunities by condition category

9. Defined Governance and Oversight Structure

- Coding QA audits

- Clinical validation layers

- Compliance sign-off

- Version-controlled documentation trails

10. RADV and OIG Audit Alignment

Given CMS’s intensified RADV enforcement, you should expect the retrospective methodology to mirror audit standards, not internal convenience.

CMS has estimated improper MA payments in the billions annually, making defensibility non-negotiable.

11. Integration With Prospective and Concurrent Programs

- Prospective suspecting models

- Concurrent documentation improvement workflows

- Provider education initiatives

12. Clear Compliance Risk Assessment

- Identification of compliance vulnerabilities

- Documentation of excluded diagnoses

- Risk mitigation recommendations

13. Provider Communication and Change Management Planning

- How and when providers are informed

- Educational content tailored to documentation gaps

- Non-punitive improvement frameworks

14. Realistic ROI and Performance Expectations

15. A Scalable, Repeatable Operating Model

- A recurring capability

- A learning system

- A continuously improving function

Best Practices for Payor Leaders to Maximize Retrospective Review Value

Start With Analytics, Not Charts

Use data science to guide effort — not manual sampling.

Build Audit Readiness Into Every Step

If it cannot survive RADV, it should not be submitted.

Close the Loop With Providers

Turn findings into forward-looking documentation improvement.

Measure Trends, Not Just One-Year Gains

Sustained improvement matters more than short-term lift.

Final Takeaway for Risk Adjustment and Network Leaders

When designed strategically, these engagements:

- Improve RAF accuracy

- Reduce audit exposure

- Strengthen provider documentation

- Support long-term value-based success

As a leader, your role is to ensure the engagement is data-driven, audit-defensible, provider-aware, and strategically integrated.

When those elements are in place, retrospective reviews become one of the most powerful tools in your risk adjustment arsenal.

Author Bio:

Kanar Kokoy

CEO - Chirok Health

Healthcare CEO & CDI/RCM innovator. I help orgs boost accuracy, integrity & revenue via truthful clinical docs. Led transformations in CDI, coding, AI solutions, audits & VBC for health systems, ACOs & more. Let’s connect to modernize workflows.